MechaMesh Tokenomics

Comprehensive overview of the $MECHA token economy

Total Supply

7,000,000 $MECHA

Initial Price

$0.05 USD

Market Cap

$350,000 USD (Initial)

Token Overview

The $MECHA token is the native utility token of the MechaMesh ecosystem, designed to facilitate transactions, incentivize participation, and govern the platform. As a Solana-based SPL token, $MECHA benefits from high throughput, low transaction costs, and energy efficiency.

$MECHA serves as the primary medium of exchange within the MechaMesh ecosystem, enabling seamless interactions between robot owners, AI developers, hardware manufacturers, and users requiring robotic services.

Token Fundamentals

- •Token Type: Solana SPL Token

- •Blockchain: Solana

- •Decimals: 9

- •Max Supply: 7,000,000 $MECHA

- •Emission Schedule: Deflationary with controlled release

Compliance & Security

- •Audited: Full security audit by leading blockchain security firms

- •Multisig Treasury: 5/9 multisig for treasury management

- •Time-locked Contracts: For team and investor allocations

- •Regulatory Compliance: Designed with global regulatory considerations

Token Utility & Use Cases

Marketplace Transactions

$MECHA is used for all transactions in the task marketplace, including task creation, bidding, and payment for robotic services.

Staking & Rewards

Token holders can stake $MECHA to earn passive income, secure the network, and gain access to premium features.

Insurance Pool Contributions

$MECHA is used to contribute to insurance pools that protect robot owners and service users from potential losses.

Swarm AI Incentives

AI developers and compute providers earn $MECHA for contributing to the decentralized swarm intelligence network.

Robot Registration & Verification

$MECHA is required for registering robots on the platform and obtaining verification credentials.

Governance Voting

Token holders can participate in platform governance by voting on proposals with their staked $MECHA tokens.

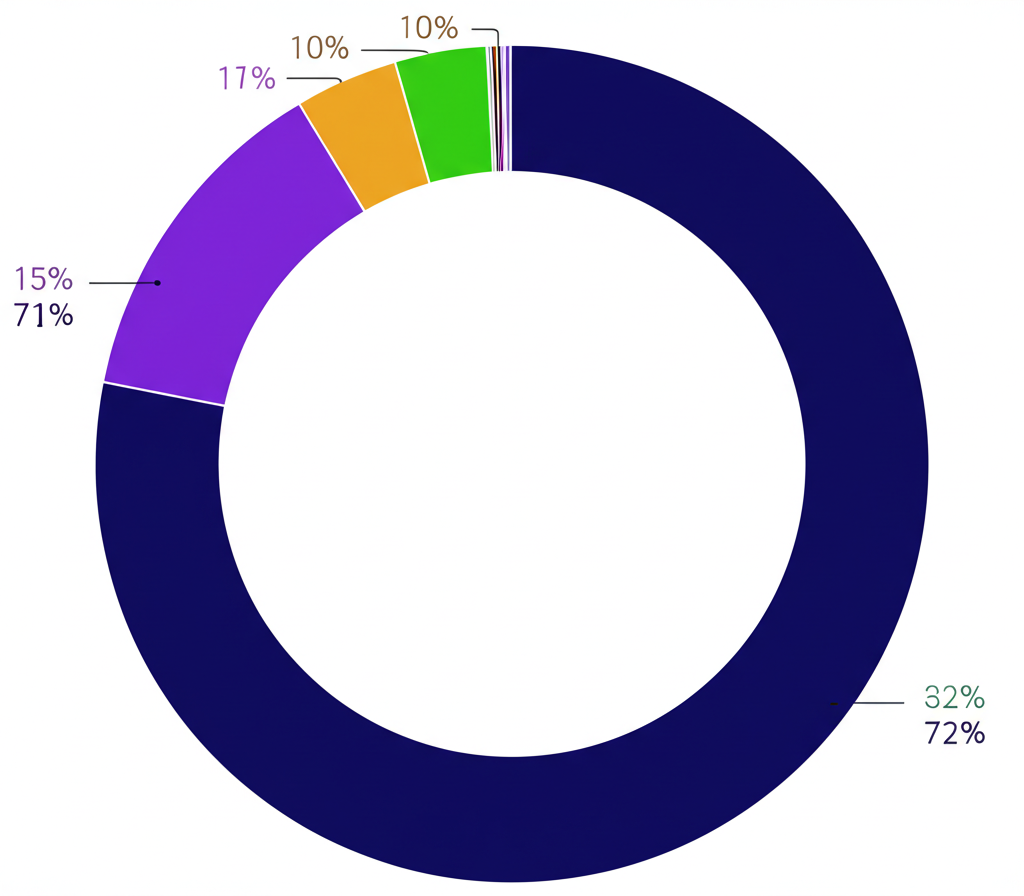

Token Distribution & Allocation

Allocation Breakdown

- Liquidity Provision72%

- Community Rewards15%

- Team & Advisors10%

- Marketing3%

Vesting Schedule

| Allocation | Tokens | Cliff | Vesting Period |

|---|---|---|---|

| Liquidity Provision | 5,040,000 | None | Immediate |

| Community Rewards | 1,050,000 | None | 48 months |

| Team & Advisors | 700,000 | 12 months | 36 months |

| Marketing | 210,000 | 3 months | 24 months |

Token Economics

Deflationary Mechanisms

- •Transaction Burn:

0.5% of all marketplace transaction fees are burned, permanently reducing the token supply.

- •Registration Burn:

10% of robot registration fees are burned, creating deflationary pressure as the network grows.

- •Buyback & Burn:

Quarterly buyback and burn events using 15% of platform revenue to reduce circulating supply.

Value Accrual Mechanisms

- •Fee Sharing:

30% of platform fees are distributed to stakers, creating passive income for token holders.

- •Utility Demand:

Growing ecosystem creates increasing demand for $MECHA tokens for various platform activities.

- •Governance Value:

Governance rights become more valuable as the platform grows, increasing token demand.

Fee Structure

| Activity | Fee | Distribution |

|---|---|---|

| Marketplace Transactions | 2.5% | 30% to stakers, 55% to treasury, 15% to insurance, 0.5% burned |

| Robot Registration | 100 $MECHA | 50% to treasury, 40% to verification pool, 10% burned |

| Swarm AI Computation | Variable | 80% to compute providers, 15% to treasury, 5% to stakers |

| Insurance Claims | 5% | 95% to claimant, 5% to verification validators |

Emission Schedule

The $MECHA token follows a deflationary emission schedule, with the highest emission rate in the first year to bootstrap the ecosystem, followed by a gradual decrease in emission rate over the subsequent years.

Staking & Rewards

Staking Tiers

| Tier | Requirement | Benefits |

|---|---|---|

| Bronze | 100 $MECHA | Basic fee sharing, voting rights |

| Silver | 500 $MECHA | Enhanced fee sharing, priority marketplace access |

| Gold | 2,000 $MECHA | Premium fee sharing, reduced marketplace fees |

| Platinum | 10,000 $MECHA | Maximum fee sharing, zero marketplace fees, governance weight multiplier |

Reward Mechanisms

- •Fee Sharing:

Stakers earn a proportional share of 30% of all platform transaction fees.

- •Inflation Rewards:

A portion of newly minted tokens are distributed to stakers, with higher rewards for longer lock periods.

- •Verification Rewards:

Stakers can participate in robot verification and earn additional rewards.

- •Governance Rewards:

Active participation in governance votes earns additional token rewards.

Staking Mechanics

Lock Periods

- Flexible: No lock, 1x reward multiplier

- 1 Month: 1.2x reward multiplier

- 3 Months: 1.5x reward multiplier

- 6 Months: 2x reward multiplier

- 12 Months: 3x reward multiplier

Reward Distribution

- Daily reward accrual

- Weekly distribution

- Compounding option available

- Claim anytime for flexible staking

Unstaking

- Flexible: Instant unstaking

- Locked: Early unstaking penalty

- 7-day cooldown period

- Partial unstaking supported

Governance Framework

The MechaMesh DAO governs the platform through a decentralized voting system where $MECHA stakers can propose and vote on changes to the protocol. This ensures that the platform evolves according to the collective wisdom of its community.

Governance decisions include parameter adjustments, feature prioritization, treasury allocations, and protocol upgrades. The governance system is designed to be inclusive while preventing plutocracy through quadratic voting mechanisms.

Proposal Process

- 1.Ideation:

Community members discuss ideas in the forum and gather feedback.

- 2.Formal Proposal:

Proposal is formalized and submitted on-chain (requires 1,000 $MECHA to submit).

- 3.Voting Period:

7-day voting period where stakers can cast their votes.

- 4.Execution:

If approved, the proposal is executed through the governance contract.

- 5.Implementation:

Technical team implements the approved changes.

Voting Mechanics

- •Voting Power:

Based on the square root of staked tokens (quadratic voting) to prevent plutocracy.

- •Vote Types:

For, Against, or Abstain options for each proposal.

- •Quorum:

Minimum 10% of staked tokens must participate for a valid vote.

- •Approval Threshold:

66% majority required for standard proposals, 75% for critical changes.

- •Delegation:

Stakers can delegate their voting power to trusted community members.

Governance Parameters

| Parameter | Current Value | Description |

|---|---|---|

| Proposal Threshold | 1,000 $MECHA | Minimum tokens required to submit a proposal |

| Voting Period | 7 days | Duration of the voting window |

| Quorum | 10% | Minimum participation required |

| Standard Threshold | 66% | Approval threshold for standard proposals |

| Critical Threshold | 75% | Approval threshold for critical changes |

| Timelock | 48 hours | Delay between approval and execution |

Future Development

Cross-Chain Integration

Future development will include cross-chain bridges to enable $MECHA to operate across multiple blockchain ecosystems, expanding its utility and accessibility.

Insurance Derivatives

Development of tokenized insurance derivatives that allow for risk trading and more efficient capital allocation within the insurance pools.

Synthetic Robot Assets

Creation of synthetic assets that represent fractional ownership of robots, enabling broader participation in the robot economy.

This document is subject to updates and revisions as the MechaMesh ecosystem evolves.

Last Updated: May 22, 2025